Home » Student travel insurance » Student travel insurance abroad

Travel insurance for students abroad

- From €26/month

Have you obtained a student visa to study abroad? A work placement outside France? Congratulations! But before you leave, don’t forget to take out student travel insurance.

Why take out travel health insurance abroad?

1

Without student travel insurance, in the event of a claim, you will not be automatically covered or will be insufficiently compensated by your social security or bank card insurance.

2

Your bank card only covers stays of up to 3 months. Compensation from your bank insurance may also be conditional on payment of a very expensive excess, the amount of which you will have to pay in advance while awaiting reimbursement.

3

The EHIC (European Health Insurance Card) is only valid for student travel within the European Union, the European Economic Area and Switzerland.

The advantages of this health insurance for travelling abroad

Taking out a health insurance policy for travel abroad means being insured anywhere in the world with comprehensive medical cover and civil liability.

Guarantees to anticipate all situations tailored to young people

Third-party liability for renting and private life abroad

You are covered for bodily injury, property damage and consequential loss up to €4,000,000.

24-hour repatriation assistance

If the doctors consider that you must return to your home country for further treatment, your repatriation will be fully covered.

100% cover for medical expenses and hospitalisation abroad

In the event of sudden, unforeseeable illness or accident, your medical expenses will be covered at 100% and without limit.

Presence of a relative in the event of hospitalisation

in the event of hospitalisation in your country of expatriation, we will provide a return ticket and cover hotel costs for one of your family members.

Early return of the insured

In the event of serious hospitalisation or the death of a close relative, you can benefit from an early return at the actual cost of the journey.

Baggage insurance up to €2,000

Your baggage will be protected against theft and damage, including during transport, up to €2,000.

Damage to equipment entrusted to us as part of a course

If, during your course, you damage equipment entrusted to you, you could benefit from cover of up to €12,000.

Optional

Interruption of studies up to €15,000

In the event of repatriation, early return or hospitalisation for more than 30 days, you will be entitled to a pro rata reimbursement of study costs.

Still haven't found the answer to your question?

Our advisers are available Monday to Friday from 9am to 5pm on +33 1 74 85 50 50

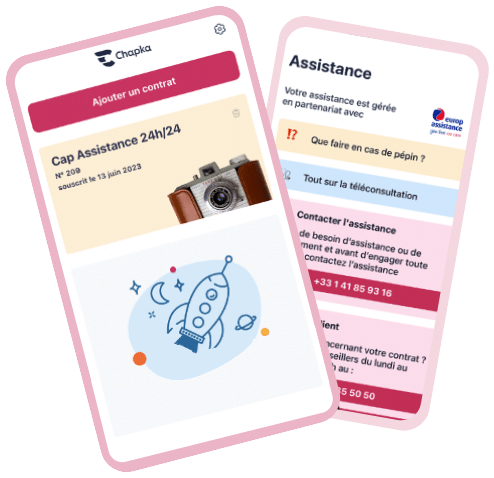

Your travel health insurance in your pocket!

With the Chapka app, keeping in touch with your insurance has never been easier.

Find all your documents

Download your insurance certificate, view your cover and your general terms and conditions.

Call your 24/7 assistance free of charge

with a simple internet connection

Report your claims

It’s easy to submit your documents and make your claims.

FAQ

What services are included in standard medicine?

Student travel insurance includes the following benefits:

– Consultation and treatment by general practitioners or specialists.

– Analyses, laboratory tests, radiology and pharmacy services.

– Nursing and physiotherapy services (following hospitalisation covered by your student travel insurance).

– Emergency dental treatment.

– Dentures and other prostheses (following a serious accident).

– Optical care (following a typical accident).

When does your insurance not work?

Your student travel insurance cover does not apply in the following cases:

– Dangerous or professional sports.

– In the event of drunkenness.

– If the consequences of an infirmity or medical condition predate the date of signature of the policy.

– Illnesses contracted before departure or health expenses that are unnecessary or not prescribed by an authorised medical practitioner.

– Repatriation assistance does not apply if the minor injuries or illnesses do not prevent the insured from continuing their trip and can be treated in the country where they are studying.

How do you pay for your student travel insurance?

You can pay for your student travel insurance in full when you take out your policy by credit card and Paypal, or opt for monthly direct debit, by SEPA mandate.

If you have opted for monthly payment by SEPA direct debit, please ensure that you have sent us the completed SEPA direct debit mandate, together with the bank details of the account to be debited – valid only for a minimum 4-month subscription on a euro-denominated account domiciled in the Single Euro Payments Area (SEPA zone).

You will be charged €3 per month. The first fee, corresponding to the first monthly instalment, must be paid when you sign up online by credit card or PayPal.

How do you manage your contract from abroad?

Log in to your customer area or download the Easy Claim mobile application to manage your contract 100% online. You can contact our advisers by phone or email.

Use the Easy Claim application as a single portal to manage all your insurance claims, view and download your policyholder card, request hospital cover and find the nearest healthcare professional, anywhere in the world.

- Online customer area

- Multilingual advisers available 24/7

- Direct payment of hospital costs 24/7

- Mandatory healthcare networks in the USA and Mexico

- Direct payment in the USA and Mexico: no advance payment for doctors’ consultations, tests, X-rays and pharmacy expenses (depending on the plan chosen).

ASSISTANCE

Assistance services provided by Europ Assistance

Present in 54 countries with :

- 750,000 referenced partners

- 35 assistance centres with a medical team available 24/7

What is the duration of the contract?

The contract is for a maximum of 12 months.

What types of travel are covered?

Your student travel insurance covers internships abroad, study trips, language stays or au pair stays.

Which countries are covered?

If you choose cover from the 1st euro or CFE cover with APRIL top-up: the main destination country determines the area of cover in which you will be covered. You can extend cover to a higher zone.

Cover is acquired in your country of nationality for periods of less than 90 consecutive days between two stays in your country of destination, only if your country of nationality is included in this list of countries.

Your country of destination will determine your area of cover.

- Zone 1: United States and worldwide.

- Zone 2: Canada, China, Mexico, Monaco, Switzerland, Russia, Singapore, United Kingdom.

- Zone 3: Rest of the world.

Up to what age does the insurance cover apply?

This cover applies to students aged under 35 at the time of signing the student travel insurance policy.

Do the packages include luggage insurance?

Yes, for the loss, theft and total or partial destruction of your luggage and personal effects during your outward and return journeys or during your stay. Cover also applies in the event of theft of your mobile phone or tablet or fraudulent use of your SIM card.

Is legal expenses insurance available?

Yes, for legal fees abroad (up to €3,000 per event) and for the advance of criminal bail abroad (up to €15,000 per event).

Is repatriation assistance available?

Yes, this service for your student travel insurance is available 24 hours a day, 365 days a year.

Please contact our teams

by telephone on +33 (0)1 41 61 23 25,

by e-mail at aic@ea-gcs.com

Our advisers will then find the most appropriate solution for your assistance needs.